Fall 2025 Endowment Report

Bucknell's endowment serves as a lasting and self-sustaining source of support, built through generous gifts dedicated to specific purposes that honor the intent of each donor. The University continues to strengthen this foundation by thoughtfully managing and growing its assets with a focus on stability, strategic stewardship and long-term success.

Since its founding in 1846, Bucknell has upheld its commitment to providing an exceptional education for ambitious and engaged students. The endowment remains central to this mission — advancing scholarships, faculty excellence, academic innovation, athletics, campus facilities and more. Through their contributions, donors help secure Bucknell's future, empowering generations of students to think critically, lead with purpose and shape a better world.

Fiscal year 2025 marked another year of progress and purpose at the University. In the Investment Office, we remain steadfast in our commitment to responsible stewardship and long-term financial strength. The following audited endowment performance for fiscal year 2025 highlights the University's continued fiscal discipline, mission-driven investment and dedication to a sustainable future.

2025 Markets Overview

Global markets experienced notable volatility but ultimately delivered substantial gains by the fiscal year's end. Major benchmarks reflected this dynamic environment, with the S&P 500 returning 15.2%, the MSCI All Country World Index (ACWI) 16.2%, the MSCI World ex US 10% and the MSCI Emerging Markets 15.3%. Both public and private investors navigated a complex backdrop shaped by shifting central bank policies, persistent geopolitical tensions and evolving capital flows, underscoring the importance of diversification and nimbleness in portfolio management.

Public equities advanced during the period, though momentum slowed from a strong 2024 performance. U.S. big tech retreated modestly after substantial gains, allowing other sectors, including industrials, healthcare, and energy, to contribute more meaningfully to returns. International equities gained traction as a weaker dollar and improving earnings boosted investor sentiment. Further easing of tensions between Iran and Israel helped further advance public equity performance.

Bond markets rebounded as inflation began to moderate in most developed countries. The U.S. Federal Reserve and European Central Bank shifted the narrative toward rate cuts following a period of restrictive policy. These narratives drove treasury and global sovereign yields lower, reflecting expectations of softer inflation and increased investor demand. Credit spreads tightened, reflecting improved financing conditions and demand for yield.

Private equity and private credit markets were active but selective. While deal values grew, reflecting improved financing and investor confidence, deal transactions declined, indicating a focus on larger transactions. Fund managers increasingly relied on continuation vehicles to retain high-quality assets and turned to secondary transactions to provide liquidity to investors. Private credit continued to serve as a critical funding source for managers despite a higher base level.

Inflation trended downward but remained above target, reinforcing caution for monetary easing. Geopolitics remained a key driver of volatility as trade disputes and tariffs reshaped the global supply chain, creating uncertainties. Conflicts in Eastern Europe and the Middle East led many investors to seek safe havens in the U.S. dollar and gold, while contributing to the volatility in energy prices. Currency markets repriced global capital flows, pressuring import-dependent economies. Uncertainties began to dissipate, as evidenced by the strong performance at fiscal year-end.

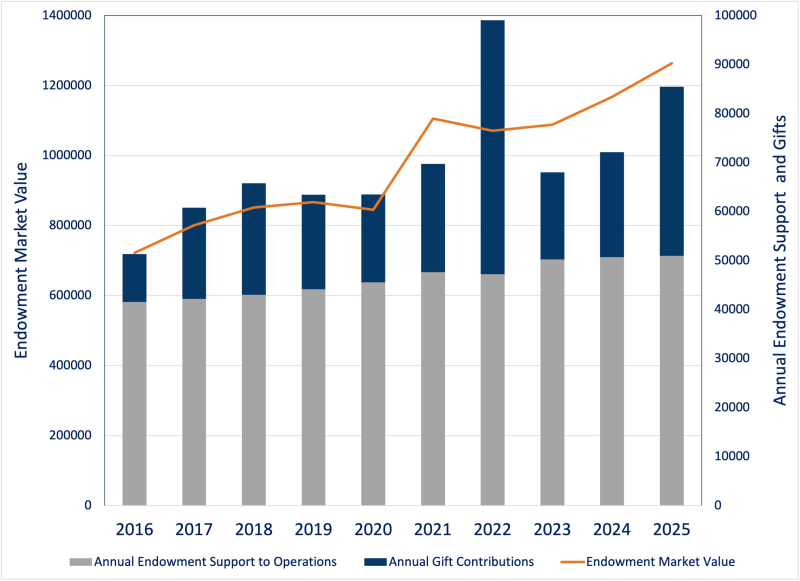

Ten-year Endowment Activity

Over the past decade, Bucknell University's endowment achieved net annualized returns of 7.5%, resulting in its value rising from $789 million in 2015 to $1.26 billion in 2025. This growth was fueled by the generosity of alumni and friends, whose gifts and other additions totaled $247 million over the period. Strategic investments and robust market performance contributed to a net appreciation of $690 million, while the endowment enabled meaningful financial support for University operations, providing $463 million for scholarships, academic programs, student and other activities.

Strategic Investing

The fiscal year revealed resilient markets and active private capital deployment despite slower growth and geopolitical risks. For Bucknell, the period reinforced the importance of diversification, vigilance, and flexibility as opportunities emerged across both public and private markets.

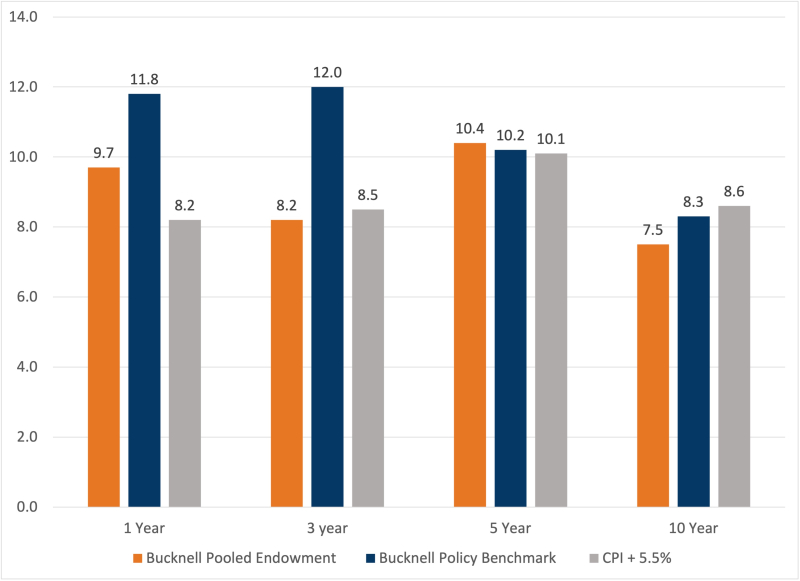

The endowment fund ended the fiscal year at an all-time high, with a market value of $1.26 billion and a positive absolute net return of 9.7%, compared to a policy benchmark return of 11.8%. While one- and ten-year results modestly trailed the benchmark, overall growth has been strong, reflecting a resilient and diversified portfolio. The Investments Committee remains focused on ensuring the fund's long-term health and is conducting a thorough review of strategies to position the endowment for sustained success.

Pooled Endowment Performance

Bucknell Primary Return Objective: 5.5% + CPI

Internal Benchmark: 64.0% MSCI AC World Index Net; 10% HFRI FOF Conservative Index; 10.0% NCREIF Open-ended Diversified Core Index - 0.25%; 8.0% Bloomberg Barclays US Aggregate Bond Index; 6% S&P/LSTALeveraged Loan Index + 150bps; 2.0% ICE BofA Merrill Lynch (ML) Hi-Yld Master

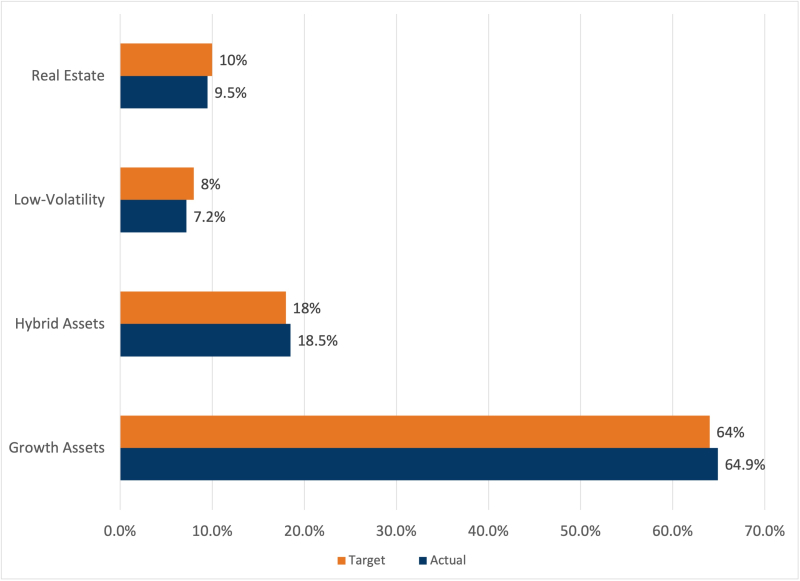

Asset Allocation

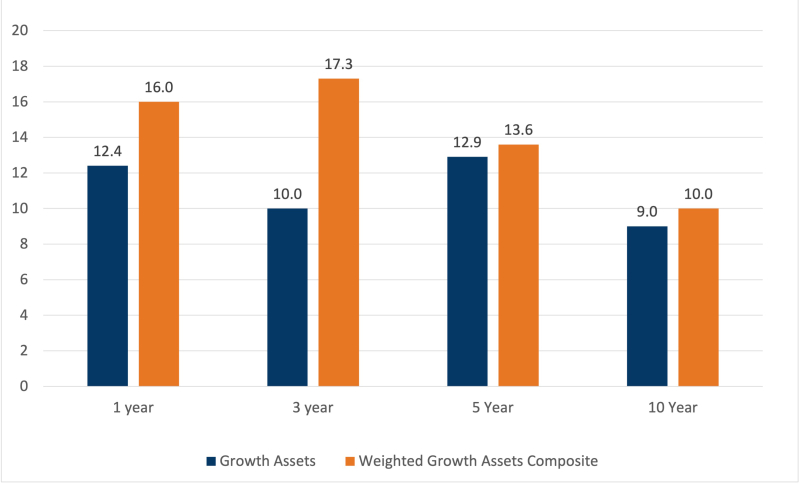

Growth Assets

Growth assets aim for long-term capital appreciation. These investments often offer higher returns but greater volatility. This group consists of U.S. and non-U.S. public and private equity investments. For the fiscal year, Bucknell's public portfolio performed in line with the benchmark, contributing to passive investment in the U.S. and outperformance from active managers internationally. Global private equity and venture capital weighed on overall relative portfolio performance as it continued to struggle against the current economic backdrop and a robust public market.

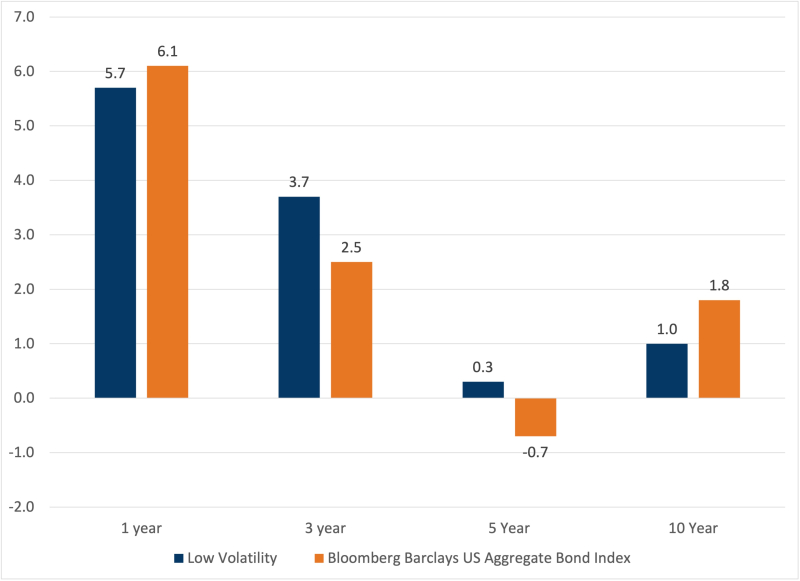

Low Volatility Assets

Low volatility assets, primarily high-quality fixed income and cash equivalents, provide stable liquidity to support the University. This fiscal year, fixed income has performed in line with the benchmark and has outperformed since a manager change in 2024.

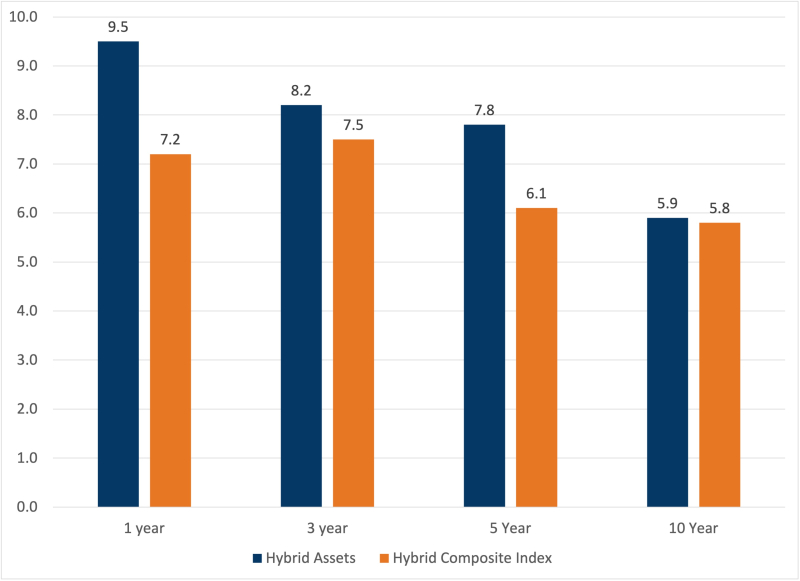

Hybrid Assets

Hybrid assets offer returns distinct from those of traditional growth assets. They enhance portfolio diversification and mitigate the impact of endowment volatility, especially during periods of market or economic stress. These investments typically exhibit lower correlation with growth assets and include hedged and credit strategies, to which credit generates attractive income and improve overall portfolio liquidity.

Hedged opportunistic strategies outperformed its benchmark and has been a long-term contributor to positive performance. The private credit portfolio yielded healthy cash distributions yet underperformed its enhanced benchmark as it absorbed new fund investment costs. Over the last 10 years, the private credit portfolio's focus on direct lending, asset-based, and opportunistic financing has outperformed its enhanced benchmark and provided a healthy yield to support cash needs.

Real Estate

Real estate produces current income and capital appreciation. The real estate portfolio is allocated to private real estate strategies diversified by geography and property type, shying away from sub-sectors prone to interest rate fluctuations and investor sentiment. For the fiscal year, real estate detracted from overall returns due to underperformance within a select concentrated sector of the portfolio, driven by demand pressures. Over a longer period, Bucknell's thematic focus in private real estate has driven significant relative portfolio performance and contribution to overall total endowment performance.